|

|

| |||

|

* This page is made by "machine translation" program from Japanese to English.

|

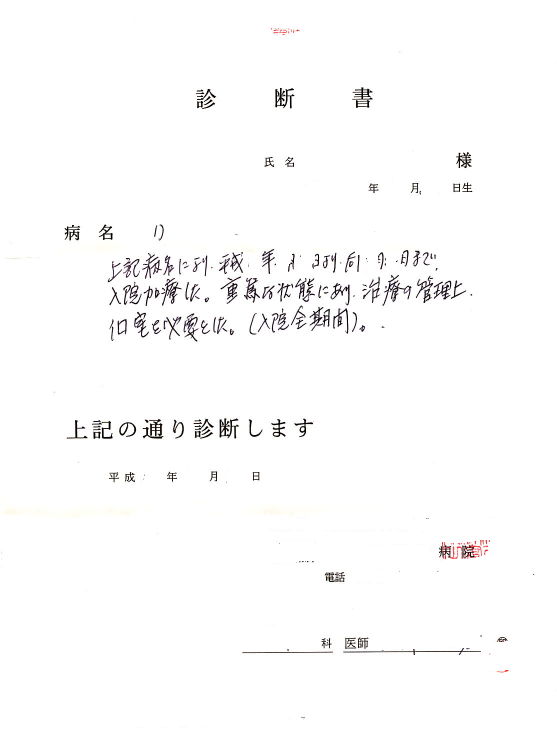

This information is concerned to tax in Japan. "The medical expenses of the charge of a hospital room not covered by a health insurance plan may also be able to be deducted." I introduce such āIāgāN information that will be lost if it does not know. if it is sent to hospital, there are condition and it is in a single room -- the charge of a hospital room not covered by a health insurance plan -- what 1000 yen per day, and paid . -- if it is 10,000 yen per day, since at least 3000 yen per about 3,600,000 yen . day are about 1 million yen -- very much -- coming out -- peevish . The one person room, the two-person room, the three-person room, the four-person room, etc. are located in a single room, and there are a charged single room, special room, special single room, and special medical-treatment environmental room, a single room A, a single room B, --, etc. in how to call by the hospital. The charge of a hospital room not covered by a health insurance plan is called a differential rate of bed, the charge of a single room, single room cost, charge of single room utilization, etc. "Deduction for medical expenses" pulls a maximum of 2 million yen of parts 100,000 yen or more (*1) from an amount of income among the medical expenses which started at the time of calculation of tax. (*1) If the earning is 2 million yen or less, the border is 5% of earnings instead of 100,000 yen. for example, since the person for whom the medical expense required 2 million yen per year of earnings by 6 million yen is . which is the reason which can calculate tax noting that earnings are 4 million yen of the difference, supposing it says him roughly and he is 20% of rates of taxation, he will return 2 million yen x20%/100%= 400,000 yen -- é▒éŲé╔é╚ (It changes with other elements, such as proportional-tax-reductions amount, in fact.) However, it is to be usually able to apply for the charge of a hospital room not covered by a health insurance plan by deduction for medical expenses. Although it is useless in the one's own convenience of since the single room is quieter, if the want top single room of medical treatment was used, a revenue office votes. I hear that it will be made to the object of deduction for medical expenses if a medical man proves with a diagnosis the reason for which the single room was required when it checks to a revenue office in charge. Then, a method is explained based on experience succeeded from now on. It goes to the window of the hospital which started and a diagnosis creation request is carried out. Probably, it will be good not to have to go probably, although it is good to make this by posting, or to telephone although for . to also want to ask you for éóé┐éŪ and a diagnosis before that. There is disturbance refused only by taking out with Åæéó to the application form of hospital predetermined diagnosis cession. Then, it is effective, if the attached sheet which entitled one more and request significance the "favor of diagnosis creation" which wrote by free form is made and being attached to a predetermined application form. In order to make it successful, let's surely do.

Now, it is -- as to what will happen, if a diagnosis is done. The hospital (there are a hospital which gives a nexus, and a hospital which does not give) which has to go to take once again, the hospital (there is also a hospital with the want of taking out a stamp to a window) which mails, the hospital which will send to a ward if in the hospital are various. Please consult with a hospital window on the methods of taking comfortably also including how to disburse the charge of diagnosis creation. . with the days scattering at one day - about three weeks concerning creation -- since there are quite a many these things, to there be also the purposes other than deduction for medical expenses and be in a hurry by declaration, it is necessary to count backward from the time limit in mid-March, and to carry out a creation request with a margin What is necessary will be just to attach one of the . notes attached when sending the declaration document to which the charge of a hospital room not covered by a health insurance plan also put the got diagnosis into the revenue office in the attached sheet.

- . by which a duty not only comes on the contrary, but local taxes come on the contrary -- even if this does not report itselves, since a nexus goes from the direction of a duty, 1/3 of the deals of easy . duty return |

(DISCLAIMER: The author, the site and the server provider have no responsibility and no warranty for the information. If you want to get absolutely accurate information for your case, please consult to National Tax Agency, the hospital, etc.)

* Link

* National Tax Agency (,Japan) homepage

* A wage earner's declaration

January, Heisei 15 and the National Tax Agency (,Japan) campaign data- (National Tax Agency (,Japan))